The prefix comes from the Greek word “kryptos,” meaning “secret” or “hidden.” And there’s plenty about cryptocurrency that feels like secret knowledge. This week, however, the US House of Representatives sought to bring some clarity to digital currencies—or at least US regulation of them—by passing three new bills. What do you need to know about the GENIUS Act, the CLARITY Act, and the CBDC Anti-Surveillance State Act? Below, our experts offer some clarity of their own on what these measures mean for cryptocurrency, Americans’ wallets, and the world.

1. What is most important to know about the three bills?

These three bills aim to provide regulatory clarity for the cryptocurrency industry, which has long been operating in a gray area, with unclear agency oversight and undefined consumer protection and compliance requirements. With these three bills, the Trump administration and Congress aim to fill these regulatory gaps and propel a broader agenda for innovation and US competitiveness in digital assets.

The GENIUS Act, which Trump signed into law today, creates the first federal regulatory framework for stablecoins, with rules for issuers and backing requirements. The CLARITY Act, which now goes to the Senate, transfers jurisdiction over digital assets from the Securities and Exchange Commission to the Commodity Futures Trading Commission and defines and establishes rules for crypto-asset exchanges, brokers, and dealers. Finally, the CBDC Anti-Surveillance State Act, which is also headed to the Senate, prohibits the Federal Reserve from issuing a central bank digital currency (CBDC) without congressional approval. There is still a lot of work to do to address remaining gaps, but these bills are a first step. Most importantly, these regulations are only effective when paired with consistent and fair enforcement

—Alisha Chhangani is an assistant director at the Atlantic Council’s GeoEconomics Center.

2. What will the impact be for Americans?

The most likely outcome is that more companies, including banks, are going to jump into offering crypto assets. We’ve already seen several major financial institutions indicate that they want to get more involved in crypto. As JPMorgan Chase CEO Jamie Dimon said Tuesday when asked about stablecoins, “We’re going to be in it and learning a lot, and [a] player.” Now that there is finally more regulatory clarity, you can expect the traditional finance players, sometimes called TradFi, to engage more with these rapidly developing technologies. For Americans, this means your bank may soon be offering you stablecoins and possibly even tokenized ways to invest in the stock market. None of this will happen overnight, but in a year or two the way we bank could look significantly different.

This also can come with risks. What happened with Silicon Valley Bank in 2022 is a cautionary tale. If banks get too involved with something speculative—whether it’s in the digital economy or not—then there is a risk that some kind of failure in one part of the market could create a larger financial crisis. These bills are aimed at helping ensure the assets offered are safe, but it’s clear there’s much more work to do on that front.

—Josh Lipsky is the chair of international economics at the Atlantic Council and the senior director of the Atlantic Council’s GeoEconomics Center.

3. What will the impact be outside of the United States?

From a policy standpoint, countries around the world have to consider the impact of dollar-denominated stablecoins on their domestic markets, while balancing their policies on stablecoins denominated in their own fiat currency (such as euro-backed or yuan-backed stablecoins) and crypto assets at large. While all the bills are focused on the domestic US market, foreign jurisdictions have been closely following these developments in Congress. Reactions from abroad have largely echoed concerns about financial stability arising from the influx of dollar-denominated stablecoins, especially (but not exclusively) from emerging markets. Other reactions have also included concerns about US President Donald Trump’s personal ventures with the crypto industry and how that could influence his policymaking. Jurisdictions abroad tend to believe that the United States is being myopic with its digital asset policies, with little examination of long-term impacts on the global economy.

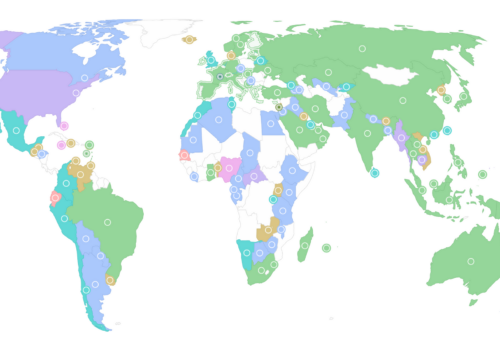

Increasingly, I see advanced economies and emerging markets doubling down on measures to protect their domestic financial stability. This includes more of an emphasis on their central bank digital currencies and adjustments to their existing stablecoin regulations, as well as creating new ones in light of developments in the United States.

—Ananya Kumar is the deputy director for future of money at the GeoEconomics Center.

4. How will these bills advance US leadership on digital assets globally?

One of the bills, the CBDC Anti-Surveillance State Act, is focused on banning the Federal Reserve from issuing a retail CBDC. A retail CBDC would be used by the general public for commercial and peer-to-peer transactions, such as buying a cup of coffee. In contrast, a wholesale CBDC would be used by financial institutions to settle interbank and securities transactions.

Supporters of this bill say they are worried about potential harms to personal privacy and about government control of daily transactions. At the same time, this bill would make the United States the only country in the world to have banned a CBDC and a global outlier in CBDC development. Importantly, the bill could potentially also undermine the Federal Reserve’s critical work on cross-border payments innovation. The Federal Reserve is actively involved in Project Agora, alongside six other central banks, to make international payments more efficient and secure by integrating tokenized central bank money and commercial bank deposits. Halting this work risks leaving the United States behind in shaping the next generation of global payment infrastructure.

This is all happening as countries increasingly pursue alternative payment systems designed to bypass the dollar. Without US leadership in cross-border payments innovation, other countries—including China—could fill the void, setting technical standards, governance norms, and financial networks that diminish the role of the dollar. This erosion of leadership also poses a national security risk, limiting the United States’ ability to monitor illicit finance and enforce economic sanctions.

—Alisha Chhangani

***

As things stand now—due to the lack of global consensus on the role of dollar-backed stablecoins and crypto assets—I see a rocky road ahead for global governance of digital assets. If there is one takeaway from the Atlantic Council GeoEconomics Center’s Cryptocurrency Regulation Tracker, it’s that jurisdictions can’t go at crypto policies alone. Creating a responsible, innovative ecosystem will take global cooperation.

The passing of the GENIUS Act offers the United States a chance to bring in other countries to respond to their concerns regarding dollar-backed stablecoins. Moreover, next year’s US presidency of the Group of Twenty (G20) is the perfect forum to do so. If the United States wants to advance its leadership on the global stage, it should take the momentum from “crypto week” and translate it into a moment of global consensus-building and cooperation.

—Ananya Kumar

Further reading

Image: US President Donald Trump holds the signed "Genius Act", which will develop regulatory framework for stablecoin cryptocurrencies and expand oversight of the industry, at the White House in Washington, D.C., U.S., July 18, 2025. REUTERS/Annabelle Gordon

English (US) ·

English (US) ·