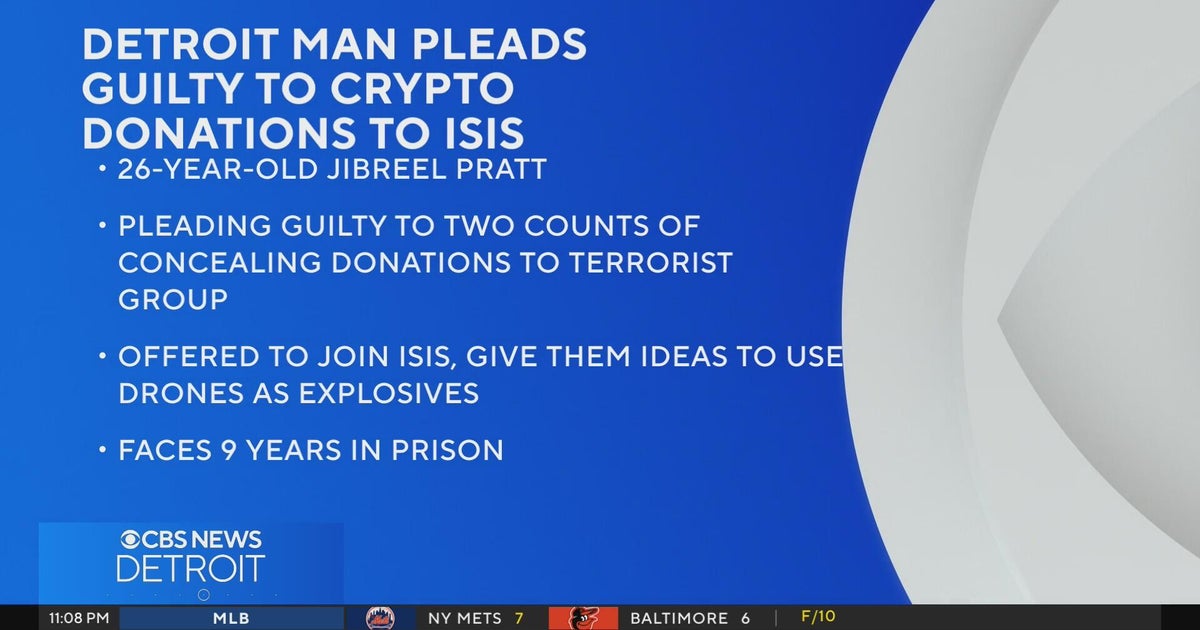

Congress may finally take steps toward regulating the cryptocurrency market.

The Digital Asset Market Clarity Act of 2025, a legislative proposal that seeks to define a regulatory framework for digital assets in the United States, has passed out of committee and is now headed to a final vote on the House floor.

The act introduces new classification standards and disclosure requirements aimed at enhancing transparency, improving investor access, and promoting innovation in the digital asset market.

On June 10, the Clarity Act received favorable committee approval from both relevant committees, clearing a crucial legislative hurdle, and now goes to a final vote on the House floor. If passed, the legislation would be referred to the Senate committees of jurisdiction for further review and negotiation.

Here’s a look at the potential impact of the act.

The Case For and Against the Clarity Act

A central component of the act is clarifying jurisdiction between the Securities and Exchange Commission and the Commodity Futures Trading Commission.

Under the current regulatory framework, regulators have relied on a piecemeal approach to regulation that has left investors in the dark about how different types of cryptocurrencies will be regulated.

This proposal would delineate which regulatory body will oversee each type of cryptocurrency by classifying them as “securities,” “commodities,” or “digital investment contract assets,” depending on their characteristics.

While consistency is a good thing, policymakers are divided on how the framework will affect investors.

Proponents argue that clearer regulatory boundaries will:

- provide investors with greater certainty about which agency oversees their investments, potentially reducing compliance costs that could be passed on to consumers and eliminating regulatory gaps that bad actors might exploit.

- help retail investors better understand the protections available for different types of digital assets and make more-informed investment decisions.

Conversely, consumer advocacy groups and critics raise serious concerns about the bill’s impact on investor safety. They argue that shifting oversight of many digital assets from the SEC—which has robust investor protection mandates and enforcement mechanisms—to the CFTC, which primarily regulates institutional commodity markets, could leave retail investors more vulnerable to fraud and market manipulation.

The SEC’s authority to require detailed disclosures, conduct regular examinations, and pursue enforcement actions against deceptive practices might be significantly curtailed under the new framework. Critics worry that this regulatory reshuffling prioritizes industry preferences over the protection of everyday investors who may lack the sophistication to navigate increasingly complex digital asset markets without strong regulatory safeguards.

How Enhanced Disclosure and Consumer Protection Provisions Benefit Investors

Sponsors of the Clarity Act argue that it establishes a multilayered disclosure and consumer protection regime that represents the most comprehensive regulatory framework for digital assets in US history. This is because:

- Developers will be required to provide accurate, relevant disclosures, including information relating to the digital asset project’s operation, ownership, and structure.

- The act will provide robust consumer protections, because customer-facing firms such as brokers and dealers must provide clear disclosures to customers and segregate customer assets from company funds. They also must mitigate conflicts of interest through strict registration, transparency, and operational standards.

The Clarity Act’s disclosure and consumer protection framework presents a complex set of trade-offs for investors in digital asset markets.

On the positive side, the comprehensive segregation requirements, qualified custodian standards, and mandatory disclosure of business operations, financial conditions, and risk factors are designed to significantly reduce investor exposure to fraud, mismanagement, and firm insolvency. This will address some of the most catastrophic risks that have plagued crypto investors, from FTX to countless smaller exchanges and projects.

The provisional registration regime and structured rulemaking timeline provide much-needed regulatory certainty, potentially attracting institutional capital and reducing the regulatory premium that has historically made digital asset investments more volatile and riskier.

However, these enhanced protections come with drawbacks for investors. Detractors believe that the compliance costs associated with segregation, custodial requirements, and disclosure obligations will likely be passed through to investors via higher fees, potentially reducing the number of innovative projects and trading venues available as smaller players exit because of the regulatory burden.

How the Clarity Act Incentivizes Decentralization and Innovation

The Clarity Act intends to incentivize innovation by creating regulatory advantages for projects that embrace genuine decentralization.

Decentralization refers to the distribution of control, authority, and decision-making power across a network of participants rather than concentrating it in a single, centralized authority (for example, a bank, government, or corporation). Decentralization is often viewed as one of the top value propositions that cryptocurrencies have to offer because it allows users to maintain direct control over their assets without needing to rely on banks or payment processors.

The legislation also aims to democratize blockchain development by eliminating compliance costs that only well-capitalized incumbents could overcome. It does so by exempting noncustodial developers, validators, and infrastructure providers from registration requirements.

Mechanically, the Clarity Act makes it easier for projects to transition from securities oversight to the more favorable commodities regulation framework, through a concept called a “mature blockchain system.”

A mature blockchain system is a network not “controlled by any person or group of persons under common control.” It also has specific criteria including open-source code, no single controlling party, and no one holding more than 20% of supply.

Once a blockchain is certified as “mature” by the SEC, it would be entitled to fewer reporting requirements, more lenient rules on insider selling, and an easier path to being listed on the cryptocurrency exchanges.

Proponents believe that this certification process transforms decentralization from a philosophical goal into a competitive advantage, offering tangible benefits for investors such as increased visibility into these projects and less market manipulation risk. Moreover, they believe that developers will strive toward achieving “mature” status, which will invariably result in innovation and propel the cryptocurrency market into the mainstream.

While mature blockchain systems may offer greater operational flexibility and reduced regulatory risk, investors lose some traditional securities law protections. Ultimately, the framework envisioned by the Clarity Act creates a series of trade-offs between innovation potential and regulatory safeguards that individual investors must evaluate based on their risk tolerance and investment objectives.

What’s Next for the Clarity Act

The Clarity Act of 2025 aims to establish a more structured regulatory environment for digital assets by clarifying oversight responsibilities, enhancing transparency for investors, and facilitating increased competition by reducing compliance costs for smaller cryptocurrency developers. While supporters view the bill as a step toward regulatory certainty and innovation, skeptics believe that the act will substantially reduce investor protections.

Ultimately, this legislation’s impact will depend on how it is implemented and interpreted by regulators if and when it is signed into law.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

English (US) ·

English (US) ·